Robert Kiyosaki was born in 1947 in Hilo, Hawaii. He had 2 fathers growing up his biological father is referred to as poor dad while rich dad was the father of his best friend Mike.

Poor Dad was highly educated and intelligent, the other dad never finished the eighth grade. Both men had contrasting points of view about money: one of a rich man and one of a poor man.

For example, one would say “The love of money is the root of all evil.” “The other would say the lack of money is the root of all evil.”

One had a habit of saying I can’t afford it and the other dad insisted on saying How can I afford it? Being a product of two strong dads, Robert would shape his financial future and fully grasp the power of money.

Rich Dad Poor Dad came out in 1997 it wasn’t an instant hit but soon sold over 32 million copies in 40 languages across 40 countries.

The Rich Don’t Work for Money

Robert and his friend Mike attended a public school where they were deemed as the poor kids. Robert and Mike weren’t invited to Jimmy’s beach house for the weekend because they were considered poor.

This led Robert to ask his dad how do I become rich? To which poor dad didn’t have the answer and suggested asking Mike’s dad for help. Rich dad owned some restaurants, warehouses, a construction company, and a chain of stores.

The lesson begins with rich dad giving Robert and Mike a few menial jobs on the weekends with very little to no pay. After a few weeks, Robert loses his mind and confronts rich dad.

Rich Dad says a job is a short-term solution to a long-term problem. When life pushes you around you can either give up or fight, it means you need to learn something.

Most people work a job they don’t like to pay the bills and the cycle continues. It’s a real-life hamster wheel. Instead, you can do what the rich do and make money work for you.

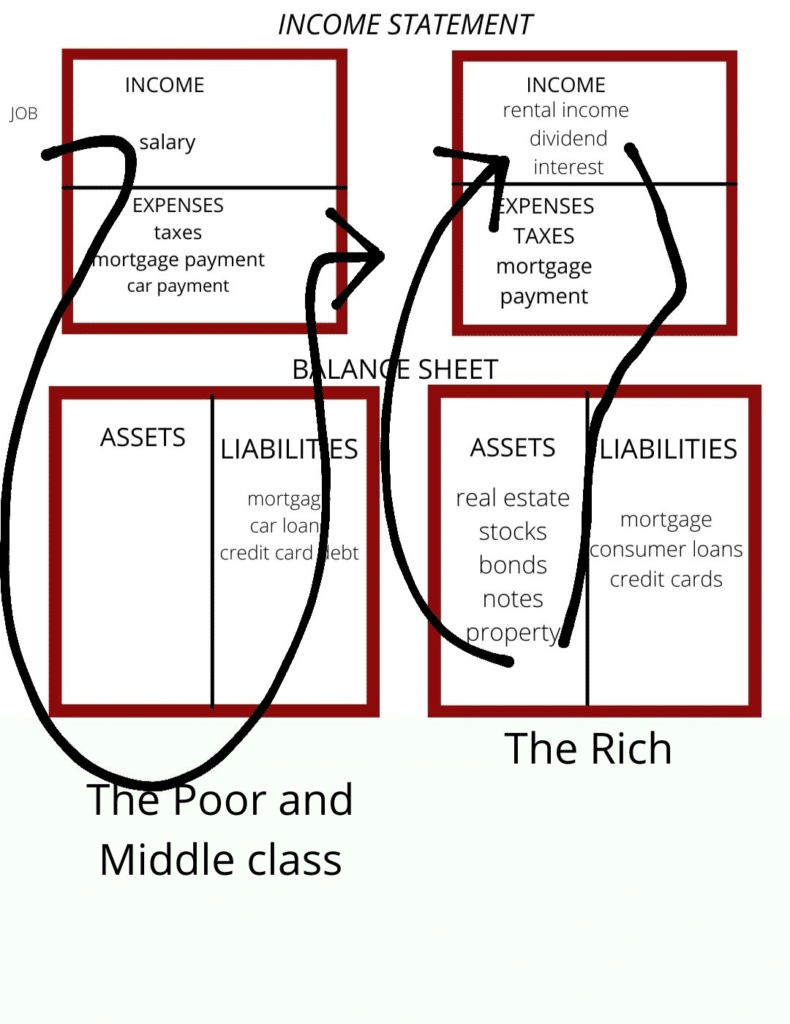

The poor and the middle-class work for money. The rich have money to work for them. If you don’t learn this lesson, you will forever continue blaming your job and your boss for your problems.

People’s lives are forever controlled by two emotions: fear and greed. Fear of not making money and greed of losing it all. This is the pattern of the rat race. Once you being to use your head, you see what others miss and an opportunity arises.

Why Teach Financial Literacy?

It’s not how much money you make, it’s how much you keep.

Rich People acquire assets The poor and middle class acquire liabilities that they think are assets. Simply put, an asset is what puts money in your pocket while a liability is what takes money out of your pocket.

Financial Literacy is important because we are not taught about money in schools. There are countless stories where athletes and celebrities make millions when they are young but are living under a bridge years later because they weren’t financially illiterate.

Wealth is the number of days a person can survive days forward without working. Cash flow tells the story of how a person handles money.

Mind Your Own Business

The rich focus on their asset columns while everyone else focuses on their income statements.

Ray Kroc, the founder of MacDonald’s asked the MBA class of 1974 what business am I in? To which they replied the hamburger business. Ray Kroc chuckled and said My Business is Real Estate. Today Macdonald’s is the single largest owner of real estate in the world.

Financial Struggle rich dad says is often the result of people working all their lives for someone else. One way to get through this trap is to buy income-generating assets like Stocks, Bonds, Notes (IOUs), and income-generating real estate.

Start Minding your own business do not quit your daytime job but start buying real assets and not liabilities, which will generate passive income.

The History of Taxes and the Power of Corporations

- Accounting: Accounting is the financial literacy or the ability to read numbers. Financial Literacy is the ability to read and understand financial statements.

- Investing: Investing is the science of money making money.

- Understanding markets: Understanding markets is the science of supply and demand.

- Corporation: A legal document that creates a legal body without a soul. Using it, the wealth of the rich is protected.

- The Law: A corporation can do many things like pay expenses before paying taxes. Employees earn and get taxed, and they try to live on what’s left. A corporation earns, spends everything it can, and is taxed on anything that is left.

In Summary:

Business owners with Corporations

- Earn

- Spend

- Pay Taxes

Employees who work for Corporations

- Earn

- Pay Taxes

- Spend

The Rich Invent Money

Often in the real world it’s not the smart who get ahead but the bold. Great opportunities are not seen with your eyes they’re seen with your mind. Most people don’t follow through because they’re afraid of failure. There is always a risk, so it’s important to learn to manage risk instead of avoiding it.

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth. Playing games is a great way of learning and they are instant feedback systems.

CASHFLOW is a game designed by Robert Kiyosaki similar to monopoly which enhances Financial Intelligence. Sometimes you win and sometimes you lose, but it’s important to always have fun.

Work to Learn – Don’t Work for Money

Job Security meant everything to poor dad while learning meant everything to rich dad. A Business Consultant once said most people are just one skill away from greatness.

School teaches us to specialize in one domain, but it’s important to know a little of a lot says, rich dad. Doing a variety of jobs gives a variety of experiences.

The main management skills of success:

- Management of Cashflow

- Management of systems

- Management of People and the most important specialized skills are sales and marketing.

Overcoming Obstacles

The primary difference between a rich person and a poor person is how they manage fear. The 5 Biggest obstacles which people face while trying to become financially independent are:

- Fear: For most people, the reason they don’t win financially is that the pain of losing money is greater than the joy of being rich.

- Cynicism: People who make decisions based on emotion and not their heads fall into this category. They doubt themselves and are very under-confident with their hunch and often listen to others instead of themselves.

- Laziness: Nowadays staying busy is confused with getting things done. To overcome laziness, it’s important to have a little greed says, rich dad. Without a little greed, the desire to have something better is not made.

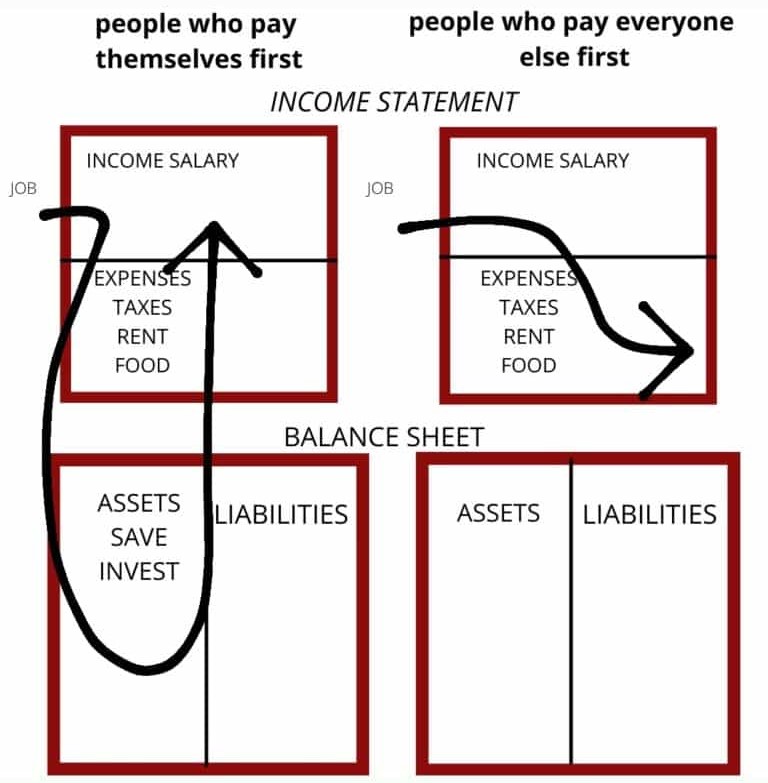

- Overcoming Bad Habits: Poor people have a bad habit of paying everybody else first and themselves last. When you do this, you’re not putting pressure to take care of yourself says, rich dad.

- Arrogance: Every time rich dad lost money, it was because he was arrogant. He thought what he didn’t know won’t matter, and that often cost him money.

Getting Started

There is gold everywhere, but most people are not trained to see it. Follow the following checklist for getting started.

- Have a clear goal or vision of why you want to get rich

- Make daily productive choices

- The power of association: Choose your friends carefully

- Pay yourself first: The power of self-discipline

- Pay your brokers well: The power of good advice

- Finally, Teach and you shall receive: The power of giving.

1 thought on “Rich Dad Poor Dad by Robert T. Kiyosaki – Summary”

thank you great refesher